Where Do You Stand? Understanding The Top 10 Percent Net Worth

Think you’ve got your finances under control? Let’s talk about the top 10 percent net worth and how it can give you a clearer picture of where you stand. Whether you’re just beginning your career or well on your way, understanding how your net worth stacks up against others your age can seriously change the way you think about planning, spending, and saving.

It’s not just about the big numbers—it’s about what those numbers mean for your life. If you’re curious about how much wealth it really takes to stand out, how your age affects your financial position, or what factors could help you reach the top, this guide breaks it all down in a way that actually matters to you.

The Truth About Joining the Top 10 Percent Today

Read also:Ximena Aacutevsaenz The Rising Star In Latin Entertainment

Let’s get real for a second: If you’re aiming to be part of the top 10 percent in the U.S., your net worth needs to be at least $1.94 million or more. That’s the baseline number, but guess what? Your age plays a huge role in determining how high that bar is set for you. Here’s a quick look at how the numbers change depending on your age group:

| Age Group | Top 10% Net Worth |

|---|---|

| 18–29 | $281,550 |

| 30–39 | $711,400 |

| 40–49 | $1,313,700 |

| 50–59 | $2,629,060 |

| 60–69 | $2,808,600 |

| 70+ | $2,547,700 |

According to data from the Federal Reserve, these figures highlight just how much wealth you need to surpass your peers. While the average household in the top 10 percent boasts a net worth of $6.9 million, households in the bottom 50 percent average only $51,000. That’s a staggering difference, and it paints a clear picture of how wealth is concentrated in a relatively small portion of the population.

Table of Contents

- How Age Shapes Your Path to the Top 10%

- How Your Wealth Stacks Up Against Peers in Your Age Group

- The Key Factors That Could Help You Reach the Top 10%

- Why the Top 10 Percent Holds So Much Wealth

- What Wealth Means to Your Generation

- The Challenges That Make Wealth Building Tougher

- How to Get Closer to the Top 10%

- Does Being in the Top 10 Percent Even Matter?

- Conclusion

How Age Shapes Your Path to the Top 10%

Your age is one of the biggest factors influencing whether you’re on track to join the top 10 percent. It’s not just about how much money you make—it’s also about when you started building wealth and how consistently you’ve been growing it over time.

If you’re a Millennial, you’ve probably managed to build $1.33 for every $1 that Gen X had at the same stage of life. Compared to Baby Boomers, you’ve built $1.32 for every $1 they had. That’s impressive progress, but let’s be honest—you’re likely dealing with rising home prices and the long-term burden of student debt.

Read also:Hannah Wow The Rising Star Redefining Pop Culture

Even if you’re doing well, wealth expectations vary dramatically by age group. The amount of net worth required to stand out changes depending on where you are in life.

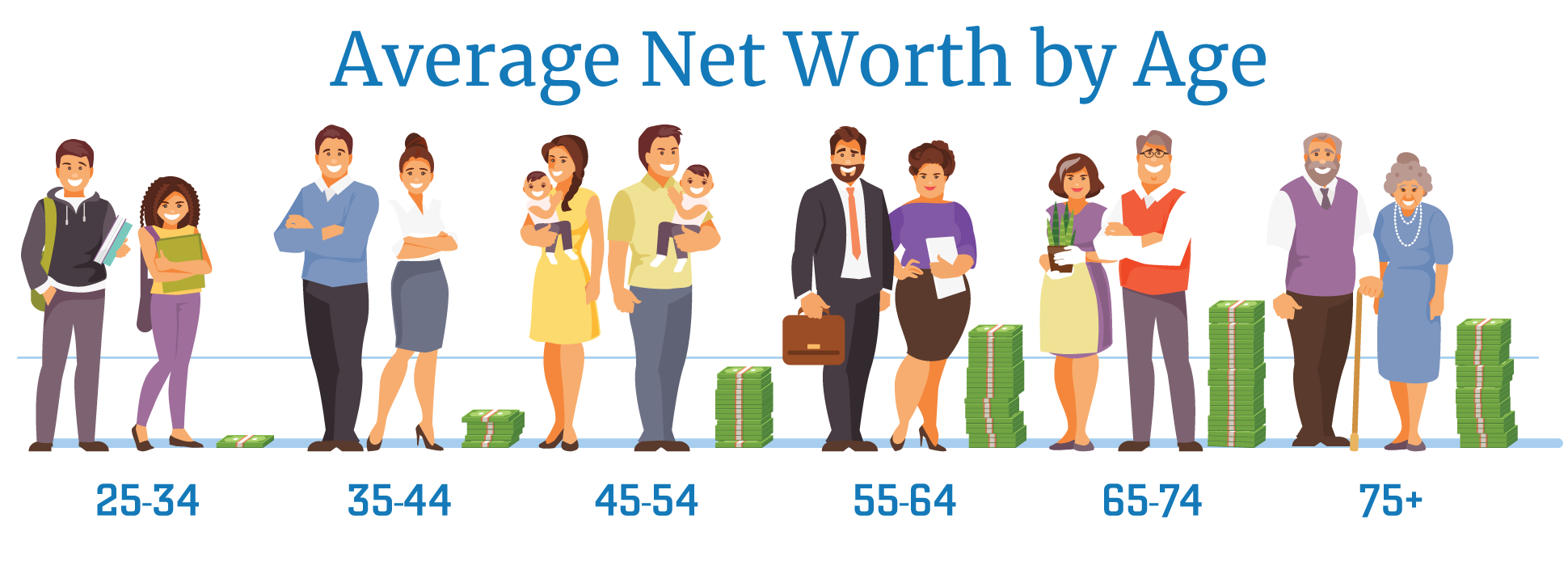

How Your Wealth Stacks Up Against Peers in Your Age Group

It’s easy to compare yourself to friends or colleagues, but sometimes the numbers tell a different story. Take a look:

- If you’re under 35, the average net worth is $183,380, but the median is just $39,040.

- Between 65 and 74, the average jumps to $1,780,720, while the median is closer to $410,000.

See the gap? A handful of extremely wealthy individuals can skew the average upward, which might make your position stronger than you think. If you’ve been comparing yourself to averages instead of median net worth, you might actually be doing better than you realize.

The Key Factors That Could Help You Reach the Top 10%

There are plenty of factors that can determine whether you’ll make it to the top 10 percent. Here are a few big ones:

- When you start investing

- Your ability to avoid high-interest debt

- The trajectory of your career and income growth

- How affordable housing was when you entered the market

Early investing, consistent saving, and the power of compound interest can be game-changers. Pair those habits with smart money management, and you’ll significantly boost your chances of success.