Mastering Your Wealth: A Deep Dive Into The Types Of Assets

Hey there, friend! Let’s talk about something that affects us all: assets. Do you really know what types of assets you own and how much they’re worth? Whether you're managing your personal finances or overseeing a business, understanding the different categories of assets can help you make smarter financial decisions. From cash in your pocket to buildings on your balance sheet, each asset plays a unique role in your financial health and growth.

In this guide, we’ll break it all down for you. We’ll explain what assets are, how they’re classified, and why they matter. Think of it as your personal financial roadmap to smarter wealth management.

Table of Contents

Read also:Ximean Saenz Unveiling The Life Career And Legacy Of A Rising Star

- What Are the Different Types of Assets and How Are They Defined?

- Current Assets: Short-Term Resources with Immediate Value

- Fixed Assets: Long-Term Resources for Ongoing Use

- Financial Assets: Market-Based Resources and Instruments

- Intangible Assets: Non-Physical Resources with Economic Value

- How Are Asset Types Reported in Financial Statements?

- Common Examples of Personal and Business Assets

- Asset Valuation and Lifespan Management

- Key Differences Between Tangible and Intangible Assets

- How Assets Differ From Liabilities and Why It Matters

- Final Thoughts on Classifying and Managing Asset Types

- Conclusion

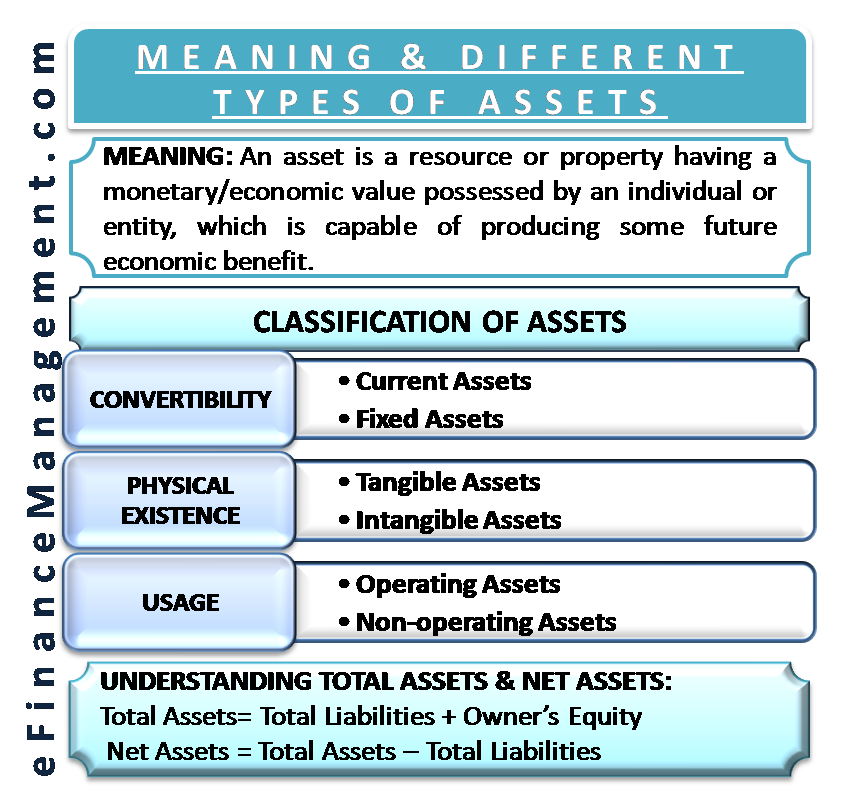

What Are the Different Types of Assets and How Are They Defined?

Assets are essentially resources that you or your company control with the goal of gaining economic benefits in the future. These benefits could range from generating cash flow to cutting operational costs or boosting revenue. But here's the deal: for something to be considered an asset, it has to create value. It’s not just about owning stuff—it’s about owning stuff that works for you.

When companies report their assets, they're not just listing random possessions. They're showing structured financial relationships. For example, when a business reports its assets, it's giving you a clear picture of its financial standing. This is how you know what the company owns and how it plans to use those resources to grow.

Current Assets: Short-Term Resources with Immediate Value

Current assets are the quick-hitters in your financial lineup. These are resources you expect to use or convert into cash within a year. They're the backbone of your day-to-day operations.

- Cash—the ultimate liquid asset. It’s always ready to meet your immediate needs, whether it’s paying bills or grabbing a quick opportunity.

- Accounts receivable—this is money owed to you by others. You need to keep a close eye on it and reassess its collectability regularly to ensure it doesn’t go south.

- Inventory—a crucial operational asset. But beware! If it becomes outdated, it could lose value fast, and you might need to adjust accordingly.

Together, these assets give businesses the flexibility and speed they need to thrive. For instance, having inventory listed as a current asset means you're ready to meet customer demands. Similarly, when accounts receivable are reported on a balance sheet, they act as a bridge between delivering a product and collecting payment.

Fixed Assets: Long-Term Resources for Ongoing Use

Fixed assets are the heavy lifters of the business world. These aren’t items for sale—they’re meant to be used over several years, providing long-term benefits.

Read also:Alexandra Dad Unveiling The Life Achievements And Legacy

Here’s what they look like:

- Buildings—these structures lose value over time due to depreciation, often calculated using the straight-line method. It’s like watching your house age, but on paper.

- Machinery—these workhorses are usually assigned a useful life of around 7 years. The more they’re used, the more they wear out, but they keep the wheels turning.

- Vehicles—like company trucks, which follow IRS guidelines and are typically given a 5-year lifespan. Knowing when to replace them is key to avoiding costly breakdowns.

These assets stay on the books longer and gradually depreciate, impacting both taxes and long-term planning. For example, the IRS assigns a useful life to vehicles, helping businesses forecast when replacements are needed. Buildings also undergo depreciation, which balances their long-term value on financial records.

Financial Assets: Market-Based Resources and Instruments

Financial assets are investments that hold monetary value. These are paper or digital items that can be traded and include:

- Bonds—known for their high liquidity and reliability. They’re like the steady partner in your financial dance.

- Mutual funds—offering diversification and ease of trading. Think of them as the team player who covers all your bases.

- Corporate or government-issued stocks—these reflect ownership in an entity and are crucial for capital gains. They’re like the star player who takes risks but brings big rewards.

These assets are subject to market conditions and are typically valued at their current market price, not their historical cost. For instance, a company might hold bonds as financial assets for stable income, while stocks represent an ownership position and are vital for capital gains.

Intangible Assets: Non-Physical Resources with Economic Value

Intangible assets are the invisible giants in the world of business. They don’t have a physical form, but they can significantly boost a company’s worth. Think about trademarks, which can skyrocket brand visibility, or patents, which provide long-term protection and a competitive edge.

Other examples include:

- Goodwill