What It Takes To Be In The Top 1 Percent Net Worth Club: Breaking It Down

Hey there, let's talk about something that’s been on a lot of people's minds: What does it take to make it into the top 1 percent net worth club? Now, I’m not just talking about earning a big paycheck. It’s about building and holding onto enough assets to put you in the top tier, ahead of 99% of everyone else. In today’s world, that means having a net worth of at least $13.7 million. And these folks don’t just own stocks or real estate—they often control entire industries.

But it’s not all about money. The influence of this elite group goes beyond the bank account. They shape policies, set investment trends, and pass down wealth through generations. In this article, we’ll explore what it takes to join the top 1 percent, how they grow their wealth, and what sets them apart from the rest of us. Let’s dive in.

Table of Contents

Read also:Xemina Saenz The Rising Star In The World Of Arts And Entertainment

- How much money qualifies someone for the top 1 percent?

- Who typically belongs to the top 1 percent?

- How is wealth concentrated among the top 1 percent?

- Why is there such a large gap between the top 1 percent and the rest?

- What role do taxes play in shaping the top 1 percent’s wealth?

- What industries and investments drive the top 1 percent’s financial growth?

- How does the top 1 percent influence economic policy and society?

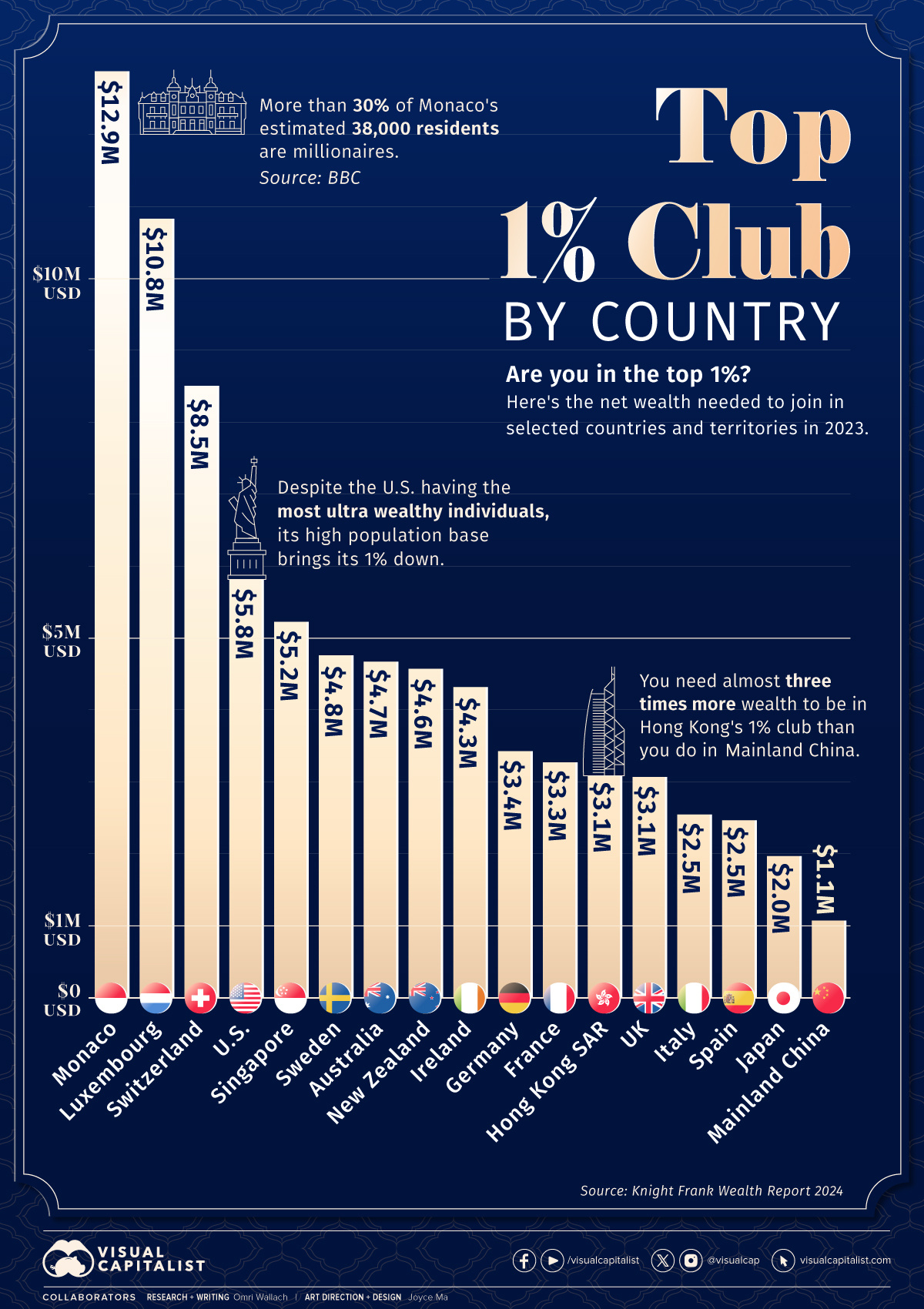

- What are the global comparisons to the U.S. top 1 percent?

- Is it becoming harder or easier to join the top 1 percent?

- Conclusion

What’s the Magic Number to Join the Top 1 Percent?

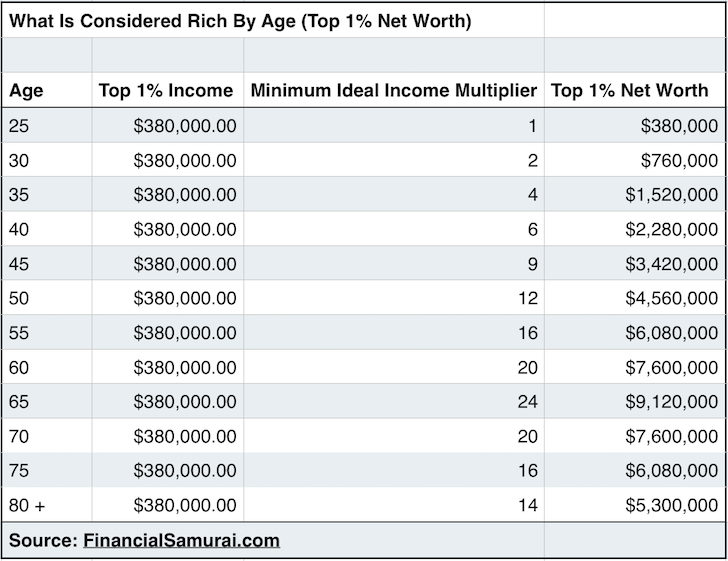

Alright, let’s get down to brass tacks. To officially claim a spot in the top 1 percent in the U.S., your household needs a net worth of at least $13.7 million. Now, if you're thinking that sounds like a lot, you're not wrong. But it’s not just about how much you earn—it’s about the assets you own. For example, someone in the top 1 percent might bring in $407,500 a year individually or $591,550 as a household, but they’ve also built up substantial wealth through stocks, real estate, and business equity.

Here’s a quick breakdown: The top 1 percent owns more than half of all equity shares in both private and public companies. That’s right—half. And when you compare that to the top 10 percent, who start at a net worth of $1.9 million, you start to see the gap widen. Only around 10% of Americans have a net worth of $2 million or more. The IRS also notes that this group pays about 40% of all federal income taxes, despite earning just 22% of the adjusted gross income. So, while they contribute a lot in taxes, they’re still holding onto an incredible amount of wealth.

Who’s in the Top 1 Percent?

Now, you might be picturing tech tycoons and Wall Street wizards, but the reality is much broader. Sure, there are plenty of entrepreneurs, corporate executives, and those who inherited their wealth, but there are also doctors, lawyers, and other professionals who’ve managed to accumulate significant assets. Take Elon Musk, for example. With a net worth of $428 billion, he’s the richest person in the world. But he’s not alone—there are 2,781 billionaires globally, controlling over $14.2 trillion in wealth.

What ties them together? Ownership. Whether it’s through their businesses, real estate, or investments, they’ve managed to build and maintain substantial wealth. It’s not just about earning a high salary—it’s about owning assets that appreciate over time. That’s how someone like Elon Musk went from founding a startup to becoming a household name worth hundreds of billions.

How Does Wealth Stack Up for the Top 1 Percent?

Let’s talk about how the top 1 percent grows their wealth. While the average person relies on their paycheck, the ultra-wealthy focus on investments. Stocks, private equity, and hedge funds are just a few of the tools they use to grow their money. In fact, according to the Economic Policy Institute, in 1962, the top 1 percent had 125 times the net worth of the average household. By 2009, that number had skyrocketed to 225 times.

Read also:Ximena Saacuteinez The Rising Star Who Shines In Arts And Entertainment

These numbers show how wealth compounds over time. The ultra-rich often reinvest their gains into other ventures, creating a snowball effect. For example, many billionaires use their money to invest in hedge funds, private equity, and other high-growth opportunities. This allows them to not only preserve their wealth but to multiply it, often at rates much higher than the average person could achieve.

Why Is the Wealth Gap So Big?

The gap between the top 1 percent and everyone else isn’t shrinking anytime soon. Between 1979 and 2020, the wages of the top 1 percent grew by 160%, while the bottom 90% saw only a 31% increase. That’s a pretty staggering difference. Meanwhile, middle-class income growth has slowed significantly, especially since the early 2000s. While the top 1 percent earns through investments, many others are stuck with stagnant wages.

The Economic Policy Institute points out that the wealth curve for the middle class has barely budged since the early 2000s. This widening gap has created a financial divide that continues to grow, with no signs of slowing down. It’s a trend that’s been decades in the making, and it’s only getting more pronounced.

How Do Taxes Affect the Top 1 Percent?

Taxes play a big role in how the top 1 percent maintains their wealth. In 2025, the estate tax exemption rose to $13.99 million, allowing families to pass on enormous amounts of money without significant tax penalties. That’s a huge advantage for those looking to preserve generational wealth. Through careful planning, the wealthy can take advantage of gift exemptions, capital gains treatments, and estate planning strategies to keep their wealth intact.

There’s been a lot of debate about how to address this. The Inflation Reduction Act of 2022 introduced a 1% stock buyback tax and a 15% minimum corporate tax, aimed at closing some of the loopholes that benefit large corporations. But the discussion is far from over. Critics argue that the current tax system still heavily favors the ultra-rich, and proposals from figures like Elizabeth Warren and Bernie Sanders have called for even stricter measures. The IRS reports that the top 1 percent pays 40% of all federal income taxes, but many believe more needs to be done to ensure everyone pays